What Is a Tweezer?

Technical analysis patterns known as tweezers, which typically consist of two candlesticks, may indicate the top or bottom of the market.

Understanding Tweezers

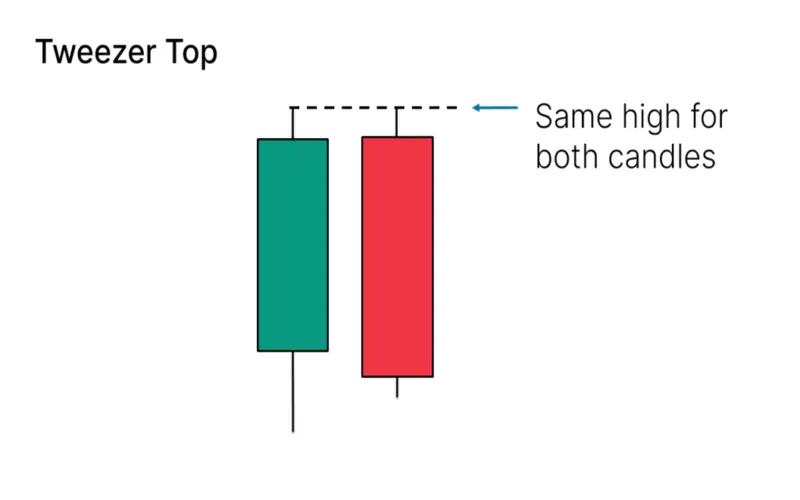

When two or more candlesticks contact the exact top, or when two or more touch the same bottom, tweezer top patterns—which are reversal patterns—occur.

Tweezer tops are seen as bearish reversals, whereas tweezer bottoms are supposed to represent short-term bullish reversal patterns. Buyers and sellers could push the top or bottom further with either structure. Both patterns need careful observation and investigation for proper interpretation and application.

When bulls drive prices higher during an uptrend, a bearish tweezer top typically happens close to the day’s highs (usually considered a strong positive indication). Then, traders change their opinion of the market on the following (second) day. As soon as the market opens, it frequently erases most of the gains from the previous day, as it does not rise beyond the previous day’s highs.

Conversely, a bullish tweezer bottom is achieved in a downtrend when bears push prices lower and conclude the day close to lows (often indicating a solid bearish trend). Once again, Day 2 is a turnaround as prices open, fail to break through the previous day’s lows, and rise swiftly. Day 2’s bullish gain can wipe out losses from Day 1’s trade.

Two candles exhibiting identical highs that happen back-to-back indicate a tweezer’s top. Two candles with comparable back-to-back lows would be seen in the case of a tweezer bottom.

Particular Points to Remember

Tweezers give traders a certain amount of accuracy as an investing technique when capitalizing on market developments. Even though tweezers might have many different looks, they always have a few characteristics: These candlestick patterns, which sometimes arise during market turning moments, may be utilized for analysis (e.g., to suggest a potential reversal merely) or, in a more general framework of market analysis, to give trend traders trade signals.

Steve Nison’s well-known candlestick charting book, Japanese Candlestick Charting Techniques, introduced tweezers to the general public. Candlestick techniques define the body of a candle, which is the difference between the opening and closing; the thin “shadows” on each end of the candle show the high and low points during that time. A white or green candle emphasizes the price closing higher than it opened, whereas a dark or red candle often implies the closure was below the open.

Tweezers should be combined with other indications or market signals, just like any other trading tool or indicator.

Conclusion

- Technical analysis patterns known as tweezers, which typically consist of two candlesticks, may indicate the top or bottom of the market.

- Tweezer tops are seen as bearish reversals, whereas tweezer bottoms are supposed to represent short-term bullish reversal patterns.

- Steve Nison’s well-known candlestick charting book, Japanese Candlestick Charting Techniques, introduced tweezers to the general public.