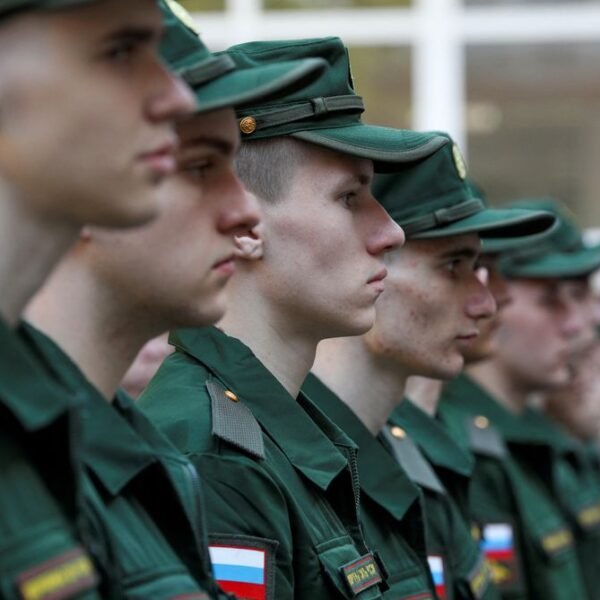

The EU sends 1.5 billion euros from Russian assets that…

President Ursula von der Leyen of the European Commission said on Friday that the EU will send 1.5 billion euros to Ukraine from Russian assets that have been frozen. After Russia sent troops into Ukraine in February 2022, the West stopped assets worth about $300 billion that belonged to Russia. Last month, the EU and... Read more