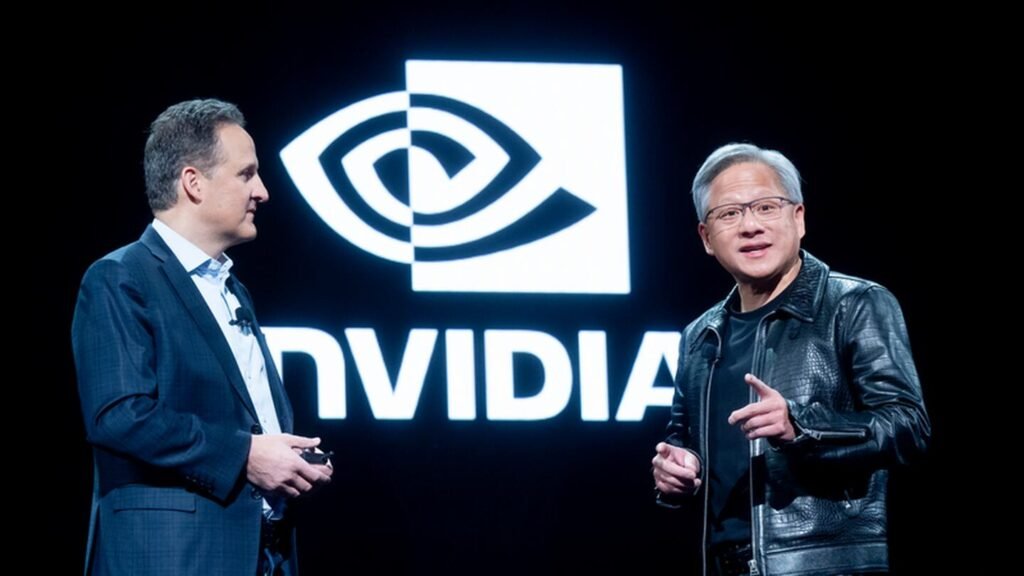

Nvidia CEO

Nvidia, the world’s leading chip maker, has declared that artificial intelligence (AI) has reached a “tipping point” as it disclosed staggering financial results, reporting a remarkable 265% increase in revenues, reaching $22 billion (£17.4 billion) in the three months ending January 28 compared to the previous year. The company’s annual turnover more than doubled, soaring to $60.9 billion.

Jensen Huang, Nvidia’s CEO, credited the surge in revenues to the tipping point reached by accelerated computing and generative AI. Huang highlighted the widespread demand for these technologies, stating that it is surging globally across various companies, industries, and nations. The company also forecasted a substantial 233% surge in quarterly revenues for the current quarter, surpassing analysts’ predictions.

Bob O’Donnell from Technalysis Research commended Nvidia’s performance, stating that the company “knocked it out of the park” in the last quarter. O’Donnell noted the shift towards mainstream usage of AI, emphasizing that it is no longer confined to specialized technology companies.

Nvidia’s success is not solely attributed to AI chips but also to the rapid growth in sales from its data centers. In the latest quarter, the data center business contributed the majority of revenues, having grown over five-fold in the past year. The gross profit for the final three months of the financial year surged by 338% to $16.8 billion, with the annual gross profit reaching $44.3 billion, marking a notable 188% increase.

Despite the outstanding financial results, Nvidia acknowledged challenges, including supply chain constraints and tightened US restrictions on trade with China, the world’s second-largest economy.

Ipek Ozkardeskaya, a senior analyst at Swissquote, described Nvidia’s results as “unusually amazing” but cautioned that challenges lie ahead. She pointed out potential difficulties such as stabilizing revenue growth, facing competition, regulatory issues, and the company’s capacity constraints in responding to rapidly increasing demand.

The rise of AI’s public profile is evident since the launch of ChatGPT in 2022, developed by Microsoft-backed OpenAI. Systems like ChatGPT utilize vast amounts of data to generate human-like responses, expected to revolutionize online information searches.

Nvidia’s stock market value experienced a staggering 225% increase over the past year, solidifying its position as one of the most valuable companies in the US. The company’s share price surged by over 9% in extended New York trading.