Oil giant Royal Dutch Shell announced a stellar quarterly net profit and a $25 billion share buyback program that aims to reduced company debt and manage oil price conditions. The company pulled in $4.69 billion in profits during the second quarter. Company analysts predicted that last quarter profits would be $5.967r billion, however, the profit pulled in represents a 30% increase.

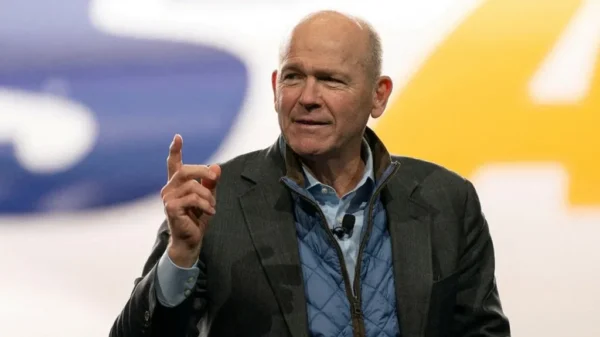

“We have delivered on the synergies, on cost takeout, on capital discipline, we’re delivering on growth and we’ve protected the dividend … And now, indeed, our cash flow and the paydown of our debt has brought us to the point where we are confident to launch a $25 billion share buyback program,” says CEO Ben van Beurden during an interview on CNBC’s “Squawk Box Europe”.

Van Buerden issued the following statements:

“Our earnings are solid. If you look at integrated gas (it was) a very good quarter and twice as good as the same quarter last year. Upstream (saw) a good, solid quarter – four times as good as the same quarter last year. Downstream is lower … And now we see a tougher environment for both refining and trading. We saw some higher costs in downstream as well as a result of a heavier maintenance program that we had.”

“This move complements the progress we have made since the completion of the BG acquisition in 2016, to reshape our portfolio through a $30 billion divestment program and new projects, to reduce net debt, and to turn off the scrip dividend.”

Shell has said that the share buyback program will last from 2018 to 2020.

Comment Template