In recent months, there has been a lot of negative crypto talk from regulators. The Bank of England took center stage late last year, warning of cryptos’ dangers to financial stability. A global crypto regulatory framework, according to the Central Bank, is also needed. The IMF asks El Salvador to exit Bitcoin (BTC).

Regulators from all over the world have been making headlines since then, with activity peaking around the turn of the year.

Several market shocks have hit the crypto market, including a proposed ban on cryptos and crypto mining in Russia.

Interconnectedness and Financial Stability

The Bank of England’s Financial Stability Report from late last year included a section on crypto assets. COVID and the Economy, Bank Resilience, and Mortgage Measures were among the other major report headings, so this was significant. The inclusion of cryptocurrency as one of four main headings reflected the Bank’s concerns about the cryptocurrency market. While noting that crypto-assets posed a low risk to UK financial stability, the Bank raised concerns about financial stability risks if the market continues to grow rapidly and becomes more interconnected with the rest of the financial system.

Earlier this year, the IMF echoed the BoE’s concerns in a blog post. The IMF mentioned in the blog that there is a growing interconnectedness between virtual assets and financial markets, particularly equity markets. As a result, market shocks can destabilize financial markets due to the interconnectedness of cryptos and equity markets.

Since the IMF blog, movements in the US equity markets and the crypto market have validated the IMF’s concerns.

El Salvador, Bitcoin, and the International Monetary Fund

There has also been a lot of news about El Salvador and cryptos in recent weeks. El Salvador is said to have been the first country to make Bitcoin (BTC) legal tender in September.

El Salvador announced plans to issue Bitcoin Bonds to fund the construction of Bitcoin City around the turn of the year. President of El Salvador, Nayib Bukele, is a strong supporter of Bitcoin. He is one of many people who believe Bitcoin will reach $100,000 in the near future.

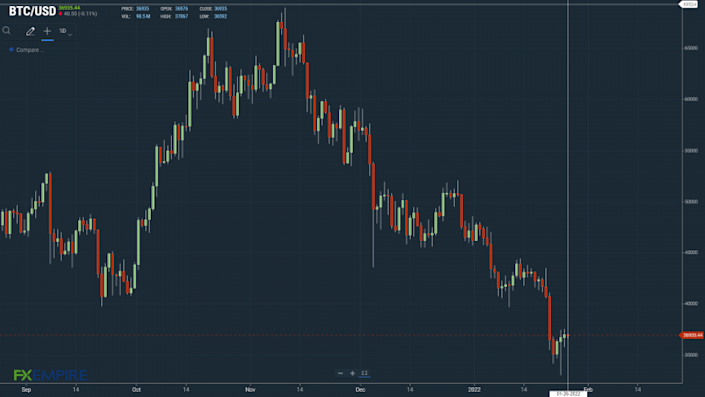

According to Tuesday’s close, Bitcoin has lost 30% of its value since becoming legal tender on September 7th. The country’s Bitcoin interconnectedness should be far more concerning than Bitcoin’s interconnectedness with US equity markets.

It’s no surprise, then, that the IMF has expressed concern and called for El Salvador to de-legitimize Bitcoin as a form of payment. The IMF warned in a press release that “the use of Bitcoin on financial stability, financial integrity, and consumer protection, as well as fiscal contingent liabilities” poses a significant risk. The 30 percent drop in Bitcoin’s value justifies the IMF’s concerns, with inflation now a major concern worldwide. While El Salvador is unlikely to use Bitcoin in commerce, consumers may be affected. The 30% drop is likely to have an impact on those who have adopted Bitcoin as a form of payment.

The IMF Executive Board reviewed El Salvador after the government of El Salvador requested a $1.3 billion loan last year.

The Price of Bitcoin

Bitcoin was down 0.11 percent to $36,935 at the time of writing. Returning to $40,000 and last week’s high of $43,513 would open the door to $45,000 levels. While regulatory action continues to have an impact, the FOMC’s monetary policy decision, rate statement, and press conference today will be crucial.

Comment Template