After nearly three years of pandemic lockdowns, investors are moving away from airplanes to invest in airports, hotels, and duty-free businesses.

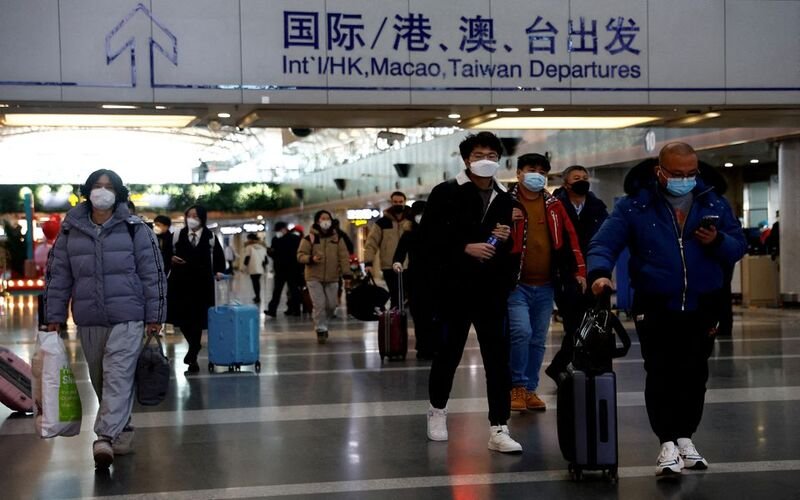

China abandoned its zero-COVID policy in December, lifting airline stocks and online travel providers like Trip.com Group Ltd.

But, with global airlines hesitant to increase capacity to connect China with the U.S. and Europe and Chinese tourists preferring domestic travel, a new group of equities is gaining.

Chinese tourists and investors have rediscovered Thailand.

“We were involved earlier in domestic travel, accommodation space, and airports, where we’ve done fairly well,” said All spring Global Investments portfolio manager Elaine Tse. Tse claimed the business had secured some bet gains.

“We expect regional and international travel to rebound and continue to acquire exposure through airports and airplane leasing.”

Airports, including the Airport of Bangkok (AOT.BK) and Shanghai International Airport (600009. SS), have underperformed Air China (601111. SS), China Eastern (600115. SS), and China Southern (600029. SS) since November, providing space for additional improvements in the former.

Investors think airline equities are pricey and volatile due to oil price changes.

Refinitiv data shows Air China and China Southern trading above their 5-year average future profits.

China Tourist Group Duty-Free Corp (601888. SS) trades at 28 times projected earnings, below the 5-year average.

Local carriers are anticipated to outperform regional airlines like Qantas (QAN.AX), Singapore Airlines (SIAL.SI), and Cathay Pacific (0293. HK) in the race for Chinese travelers because they kept more widebody planes and employees ready.

China forecasts 90 million inbound and outbound tourists in 2023, 31.5% of pre-pandemic levels. After huge losses last year, Refinitiv expects all three Chinese airlines to profit in 2023.

As foreign travel recovers, analysts anticipate Chinese airlines to profit most next year.

“We need to be patient and wait for results to come in to push values down,” said Union Bancaire Privee senior equities advisor Vey-Sern Ling.

Nordea Asset Management’s head of fundamental equities, Hilde Jenssen, has acquired consumer discretionary firms linked to tourism, such as duty-free operators, to capitalize on the reopening’s secondary impacts.

At the start of the year, investors predicted a post-pandemic splurge due to sky-high Chinese family savings, which reached 17.8 trillion yuan ($2.61 trillion) last year. Nevertheless, Chinese consumers have remained cautious.

Jenssen said results from several consumer discretionary businesses suggested they were replenishing stocks in expectation of robust demand.

“It might not be sort of the huge bang that everybody was looking for at the beginning of the year… (but) there is clearly some pent up demand.”

Comment Template