On Monday, Japan’s senior government spokesperson assured markets the banking system was stable.

Hirokazu Matsuno also applauded Sunday’s agreement by top central banks, including the BOJ, to expand an existing swap line to guarantee lenders have enough dollars to operate.

“Each government swiftly scaled up efforts when risk-aversive measures were visible in financial markets,” Matsuno told a regular news conference.

He said authorities were following financial market swings “with a deep feeling of anxiety” but that Japan’s financial system was robust.

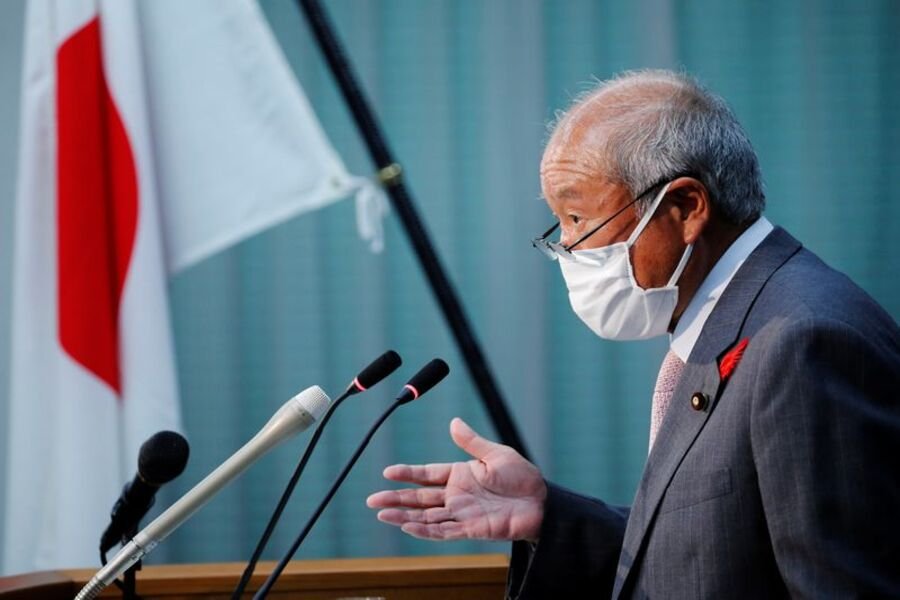

On Monday, Finance Minister Shunichi Suzuki told reporters the government would “seriously analyze” how Credit Suisse Group’s weekend rescue plan will influence Japan’s banking sector.

Asian equities stabilized on Monday after a weekend Credit Suisse rescue and coordinated central bank intervention, although financial shares remained volatile due to contagion worries.

Japanese officials said domestic banks had enough capital buffers to withstand losses from external sources, including U.S. loan collapses.

Yet the worldwide market crash complicates new BOJ Governor Kazuo Ueda’s mission of directing a seamless withdrawal from ultra-low interest rates that have garnered increasing criticism for encouraging financial institutions to take on risk in pursuit of income.

On Monday, the BOJ board discussed the adverse consequences of loose policy while maintaining ultra-low rates.

Tokyo Financial officials now view a U.S. economic downturn that hurts exports as the biggest danger to Japan.

“The market instability might affect corporate mood and obscure Japan’s economic outlook,” one official warned, echoing another. Due to sensitivity, both talked anonymously.

On Monday, the BOJ’s first dollar market operation after Sunday’s central bank statement garnered no bids, signaling market calm.

Government authorities were vigilant.

“The failure of two U.S. banks spilled over to a Swiss bank in an apparently unconnected fashion,” one official said. “We’ll need to gather data and monitor the situation,” the person added.

Comment Template